Founded in Seoul and operating from satellite hubs in Tokyo, London and Singapore, I&S Global Holdings deploys proprietary capital across liquid markets, tokenised real‑world assets and mission‑driven ventures. We are privately owned, alignment‑driven and architected for the next 50 years — not just the next quarter.

Our decisions integrate machine‑learning research with qualitative geopolitical lenses, ensuring portfolios are resilient to both regime shifts and black‑swan volatility.

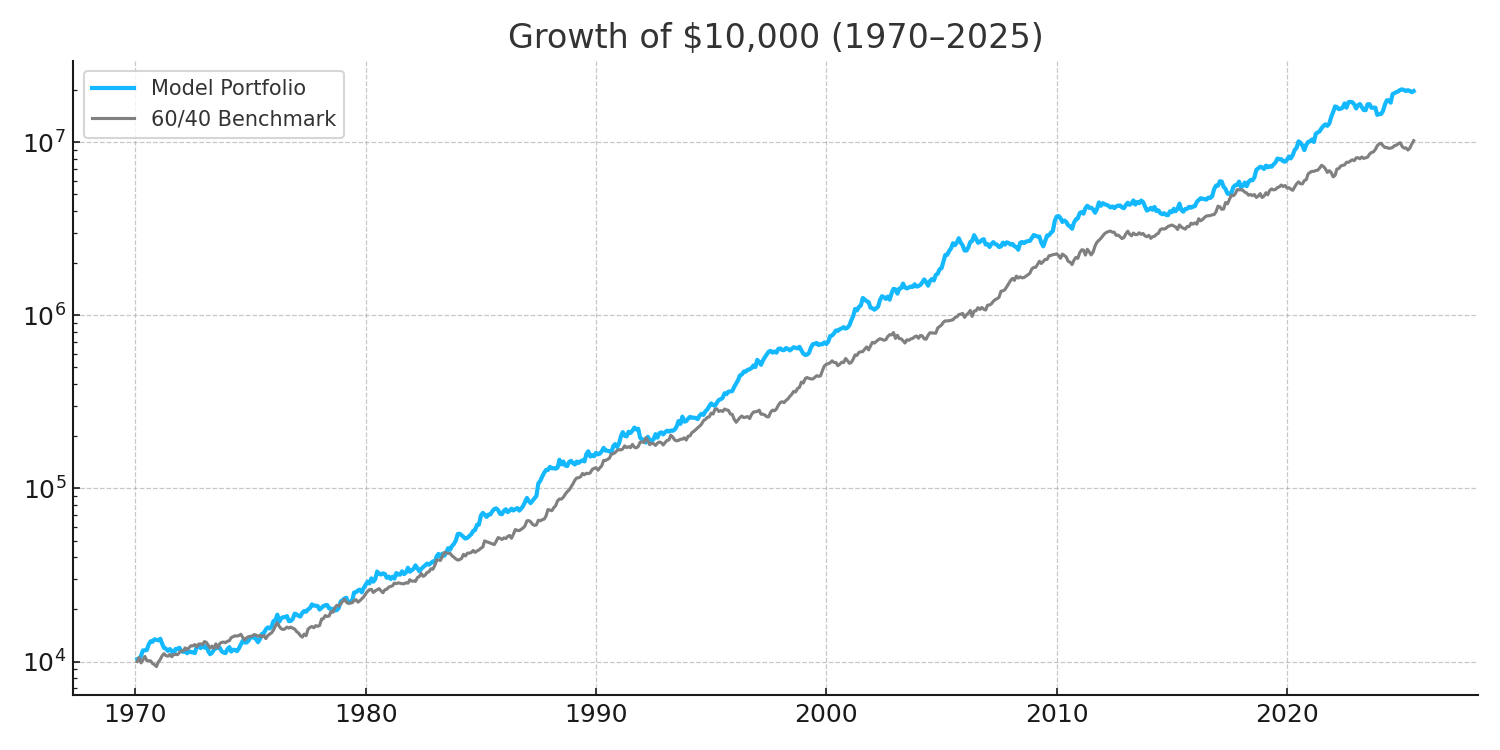

The model portfolio has compounded at ~14 % annualised since 1970 with a shallow 14 % peak‑to‑trough drawdown — half the pain of a traditional 60/40 blend. Risk‑budgeted factor rotation and dynamic hedges have delivered a Sharpe above 1 for the past decade.

Factor‑adaptive long/short strategies across MSCI DM & EM universes. Proprietary ensemble models digest 4 TB/day of pricing, macro and sentiment data, targeting consistent 5–7 % alpha with a max‑drawdown guardrail of 10 %.

Management of USD‑backed stable reserves, tokenised T‑Bills (OUSG, USDY) and over‑collateralised lending desks, delivering 6–9 % net APY with daily liquidity. All flows are audited on‑chain with Merkle‑proof attestations.

Seed‑to‑Series B cheques into AI infrastructure, carbon‑negative materials and cross‑border payment rails. We syndicate with specialist GPs and provide governance engineering, tokenomics and liquidity architecture.

Internal R&D unit building Bayesian block explorers, agent‑based liquidity bots and multilingual LLM treasury copilots. Solutions are licensed under a SaaS + performance‑share model.

We believe the future of capital markets will be borderless, transparent and composable. By marrying traditional valuation discipline with decentralised market micro‑structure, we aim to deliver returns that are uncorrelated, measurable in real‑time and aligned with long‑term planetary stewardship.

Sera Lee, Founder & Chief Architect — Kyung Hee University BBA alumna with 15 years of hands‑on investing across Tokyo, London, Singapore and Seoul. Sera’s edge lies in surgical capital preservation married to exponential upside via optionality. She is passionate about systems thinking, decentralised finance and ocean conservation.

Stay ahead with Stable Alpha Korea — our documentary YouTube series — and RWA Pulse, a monthly macro letter dissecting tokenised asset flows, basis trades and regulation.

Unit 1601, 16F, Gangnam Building, 396 Seocho‑daero, Seocho‑gu, Seoul 06619, Republic of Korea

[email protected]